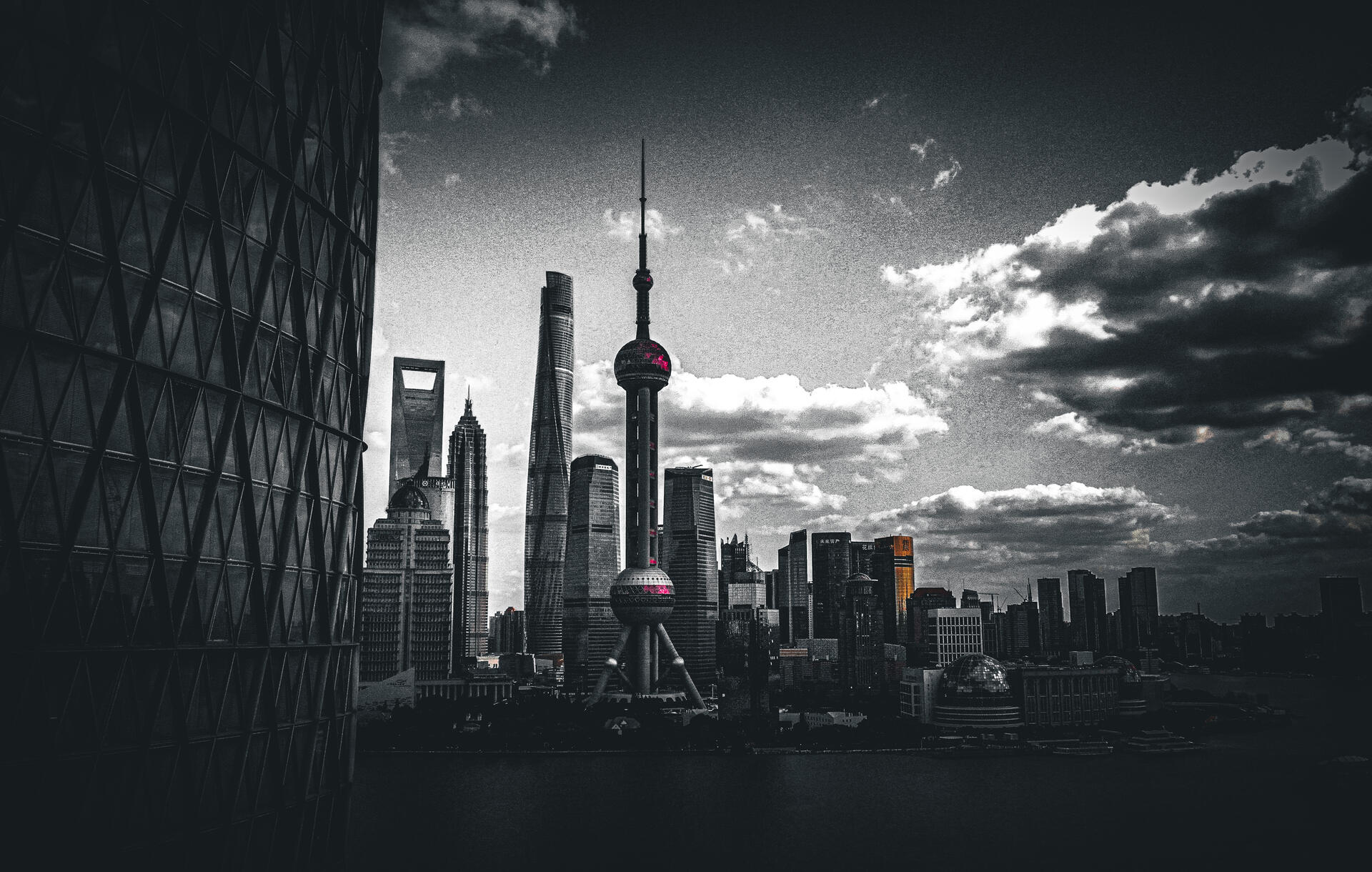

Originally published in June 2025 (Block: 902232 / USD: $102k / SatsDollar: 977). Banner image property of Hes.

Bullshit Jobs Exist Because The System Needs Them. A Bitcoin World Would Not.

In his 2018 book Bullshit Jobs, David Graeber described a strange modern affliction that hits all too close to home: millions of people—often well-educated and decently paid—secretly believe their jobs are meaningless. Not just boring or repetitive, but completely pointless. Entire sectors, he argued, exist to keep people busy doing tasks that make no real contribution to society. It’s a damning critique of how modern economies misallocate time, capital, and human energy.

While Graeber diagnosed the symptoms brilliantly, he misidentified the heart of the disease. His conclusion—that capitalism itself is to blame—confuses the free market with the manipulated atrocity we find ourselves living under today. In truth, we haven’t had real capitalism for decades. What we have is a fiat-driven system of cronyism, central bank interventions, and artificially inflated bureaucracies. It's not capitalism creating bullshit jobs—it’s a monetary system that not only rewards them, but requires them, in order to survive.

Graeber’s Core Insight: Meaningless Work in a Sick System

In Bullshit Jobs, Graeber categorized five archetypes of pointless labor—roles that feel fake not just to outsiders, but to the workers themselves. He correctly argues that these jobs exist not to produce value, but to preserve appearances, inflate hierarchies, or smooth over problems that shouldn't exist in the first place.

Each category speaks to a different failure of the system—not a failure of the market, but a failure of the bad incentives created by debt-fueled fiat economies:

Go-Betweens

Intermediaries who exist only because systems are needlessly complex or fragmented.

Examples:

- Corporate “liaisons” who simply pass emails between departments with incompatible software.

- IT consultants hired to manage integrations between bloated, outdated legacy systems.

- Sales coordinators whose job is to facilitate calls that would be unnecessary if pricing were transparent.

In a fiat economy, complexity isn’t punished—it’s rewarded with bigger budgets, more headcount, and greater organizational sprawl. Go-betweens thrive when layers of opacity are preserved for the sake of power, not productivity.

Flunkies

Employees hired to make their superiors feel important, often performing ceremonial or status-enhancing tasks.

Examples:

- Personal assistants to executives who insist on being shielded from their own calendar.

- Interns hired solely to greet guests, refill coffee, or be seen in meetings to validate a sense of importance.

- Staffers in large bureaucracies whose only function is to echo or flatter leadership talking points.

In hierarchies where status is everything, appearances matter more than outcomes. Fiat systems allow unproductive prestige roles to persist because they’re paid for not with earned revenue, but with cheap money and inflated budgets.

Box Tickers

People hired to fill out forms, compile reports, or meet compliance requirements that don’t actually improve outcomes.

Examples:

- Diversity officers required to generate DEI metrics, regardless of any cultural change.

- Corporate social responsibility managers producing annual reports no customer reads.

- Teachers forced to spend hours documenting lesson plans to meet administrative quotas.

In a heavily regulated, fiat-backed economy, the optics of accountability matter more than actual impact. Compliance becomes a job category in itself, rather than a byproduct of good practice. Box tickers serve systems that measure inputs, not results.

Duct Tapers

Workers who are constantly fixing or compensating for systemic problems that shouldn’t exist in the first place.

Examples:

- Customer service agents apologizing endlessly for broken products or poor policies they can’t change.

- IT help desk workers who spend their day resetting passwords and restarting machines because the core tech is outdated.

- Administrative staff who manually transfer data between platforms because software isn’t interoperable.

When companies are incentivized to maximize short-term profits over long-term fixes, they’ll paper over problems rather than address root causes. In fiat economies, cheap labor and abundant capital make it “easier” to throw people at the problem than to solve it systemically.

Taskmasters

Managers who create unnecessary layers of oversight, meetings, and control over people who could function independently.

Examples:

- Mid-level project managers whose main function is to schedule daily stand-ups and report to other project managers.

- Executive VPs of “Strategy” whose deliverables are vague decks, vision statements, and memos that lead nowhere.

- Bureaucratic supervisors whose main task is to track productivity metrics in systems where trust is absent.

In a fiat economy bloated with credit and managerialism, tasks multiply to justify salaries. When failure is subsidized, leadership structures grow horizontally rather than vertically—layer upon layer of oversight, all afraid to relinquish control.

The Fiat System: A Bullshit Job Generator

Graeber’s classification of bullshit jobs—while often humorous and sharp in its critique—unveils something far more tragic than absurd: that millions of people quietly know their work is unnecessary, even fake. These jobs do not emerge from organic market demand. They are not expressions of entrepreneurship or voluntary exchange. Together, these five categories describe a world where labor is not a measure of value, but of institutional inertia. These roles flourish in both public and private sectors—not because consumers demand them, but because inflated budgets, compliance culture, and fiat financing allow them to persist.

These jobs aren’t sustained by market forces. They’re sustained by a system where prices lie, failure is subsidized, and truth is distorted by monetary manipulation

This is the core of the illusion: we assume that because people are working, value is being created. But that assumption breaks down under the slightest bit of scrutiny. People spend entire careers producing reports that are never read, sitting in meetings to justify other meetings, correcting problems that were only created to support a job that didn’t need to exist. The machine feeds itself. It doesn’t matter if the work contributes to the well-being of others—it matters only that the system keeps spinning, and that workers continue to receive enough compensation to remain dependent.

What Graeber sees as a failure of capitalism is more accurately a distortion caused by fiat money. Capitalism, at its core, is a system of voluntary exchange based on real prices, risk, and reward. When practiced under sound money like Bitcoin, it eliminates inefficiency through natural selection: bad businesses fail, waste is punished, and success is measured by the satisfaction of others. Fiat breaks this feedback loop. When central banks can create money out of nothing, prices no longer reflect scarcity or human preference. Instead, they reflect proximity to the monetary spigot—cheap credit, government subsidy, or regulatory protection. What we’re actually living under is fiat statism: a fusion of centralized money and bureaucratic economics, where survival depends not on serving others—but on staying close to that spigot of freshly printed money.

The result is an economic environment where failure is propped up and fake work can thrive. Bureaucracies multiply not because they’re needed, but because they’re budgeted. Managers manage people who don’t need managing. Employees fulfill procedures written not for function but for liability. Industries flourish around complexity that ought to have been simplified—compliance departments, endless back-office layers, entire consultancies devoted to navigating the very red tape that sustains them.

The absurdity compounds. But the money keeps flowing, so the jobs stay alive.

Austrian economists warned of this dynamic. They spoke of malinvestment—capital flowing into unsustainable ventures not because of actual demand, but because artificially low interest rates signal false opportunities. In a fiat system, companies grow bloated on debt and subsidies, not on efficiency or innovation. Their labor force is not trimmed to serve a need but expanded to justify the illusion of growth. These bullshit jobs are not side effects—they are symptoms of the disease.

Jeff Booth, in The Price of Tomorrow, takes this a step further. He points out that exponential technological advancement should be driving massive deflation. We should be working less, owning more, and watching our cost of living fall as tools become cheaper, faster, and more powerful. We’ve been taught to fear deflation. But why? Under a deflationary system, prices fall as technology improves. That’s good. It means we’re getting more for less.

As Booth argues, technological deflation is the natural state of progress. Software eats costs. Automation replaces labor. Machines don’t just augment human effort—they replace entire industries. That’s not a crisis. That’s success. Why did calculators, cameras, and GPS units become free inside our phones? Because capitalism, unimpeded, drives marginal costs toward zero.

The fiat system fights this progress.

It needs people to work more hours each year to sustain consumption. It sees abundance not as a triumph—but a threat to employment statistics. We print more money to simulate growth, forcing people to work longer hours to maintain the same standard of living. We don’t celebrate efficiency—we subsidize redundancy. We don’t liberate the worker—we invent more work to keep them occupied. Booth’s insight aligns with the Austrian warning: our system can’t tolerate real progress, because its foundation is debt. And debt must be repaid—either with inflated currency or with your time.

That’s why we invent bullshit jobs: to mask the fact that we no longer need as much labor. Instead of letting people benefit from deflation, we chain them to fake work just to scrape by.

Bitcoin as Economic Truth

When the system is honest, the jobs that existed to game it disappear.

Bitcoin is the answer to the madness—not because it fixes labor directly, but because it fixes the signal. Under a Bitcoin standard, jobs must justify themselves. There is no central bank to fund pointless initiatives. There is no inflation to subsidize fake productivity. Scarce money forces honest decisions. It enforces efficiency through economic gravity. With no way to counterfeit capital, companies must produce real value to survive.

Because Bitcoin is deflationary by nature, technological progress no longer needs to be masked or feared. Prices fall naturally, and people gain time instead of losing it. Bitcoin embraces deflation. It lets prices fall. It lets time be reclaimed. It rewards productivity, not motion.

That shift is monumental. In a world where money gains purchasing power over time, the need to work simply to stay afloat disappears. People can save. They can rest. They can walk away from meaningless jobs. They are no longer required to “stay busy” just to maintain purchasing power. Instead, they can focus on work that matters—or no work at all. Automation doesn’t have to be a threat to employment. It becomes a gift. It liberates time. Bitcoin allows that liberation to be economically viable.

This is where time preference enters the equation. High time preference—prioritizing the now at the expense of the future—is incentivized by fiat. Why save when money melts? Why build when consumption is easier? Bitcoin reverses this. Its fixed supply makes future value meaningful. With a low time preference, individuals can plan. They can invest in projects that may not pay off for decades. They can work less, save more, and spend time on family, health, or creativity. The bullshit job dissolves not because it is outlawed—but because it no longer makes sense.

Even the social fabric frays under fiat pressure. Graeber noted how dual-income households have become the norm, not because families want two full-time jobs, but because one income is no longer enough. And when both parents are gone, more jobs are created to take their place—childcare, food delivery, after-school programs—more economic activity, but less connection. Bitcoin begins to restore sanity here too. With real savings and lower cost of living, families can reclaim their time. One parent might choose to stay home. Or both could work part time.

It’s not just economic reordering—it’s civilizational repair.

And underneath it all lies the most important piece: cryptography. The real innovation behind Bitcoin isn’t some abstract “blockchain” (a term captured by marketing departments and crypto scams). It’s the cold, uncompromising certainty of math. Cryptography enforces the rules. It makes fraud impossible and favoritism obsolete. In a world built on code as law, no one gets to cheat. No one can print more Bitcoin. No one can override the protocol at will. It is a trustless system—not because it lacks trust, but because it removes the need for it.

This is the cypherpunk revolution. Not through protest or policy, but through protocol. Not through persuasion, but through code. Bitcoin doesn’t appeal to power—it routes around it. And in doing so, it renders entire categories of bullshit jobs obsolete. There is no need for compliance departments when the rules are enforced mathematically. There is no room for rent-seeking middlemen when value moves peer-to-peer. There is no demand for bureaucratic managers when coordination happens through open protocols. When the system is honest, the jobs that existed to game it disappear. This is how freedom scales: not by politics, but by cryptographic enforcement.

In this system:

There are no subsidies for zombie corporations.

Bad businesses fail—and their resources are reallocated.

Jobs must create value or they disappear.

The question is no longer “how do we create more jobs?” but “why are we still working so much?” If the goal of civilization is to increase leisure, abundance, and freedom, then bullshit jobs are a betrayal of progress. They are not signs of a healthy economy—they are symptoms of one in decline.

This is how bullshit jobs die: not by legislation, but by exposure to reality.

Bitcoin is an Exit from the Bullshit Economy

David Graeber revealed a deep dysfunction in the modern economy: millions of people doing work that neither inspires them nor benefits others. He saw clearly that millions are trapped in labor that feels hollow—labor that exists not because it’s needed, but because the system would collapse without the illusion of productivity. His instinct was to blame capitalism. But the deeper truth is more radical: this isn’t capitalism at all. It’s fiat deception masquerading as a market.

Bitcoin clears away the fog. It restores price integrity. It aligns incentives. It rewards value, not velocity. In a Bitcoin world, we don’t need to create fake work to keep people fed. We let prices fall. We let time be reclaimed. We let people walk away from bullshit.

Bullshit jobs exist because the system needs them. A Bitcoin world would not.

In that world, we work to create—not to comply. We build what lasts. We pursue freedom. And we remember that the goal of progress was never more jobs—it was less work for a better life.

That’s not just a better economy. That’s a better life.

More Reads from Hes:

"The Bitcoin Time-Perspective"

The Ultimate Monthlong Guide to Myanmar

Find More:

All images are credit of Hes, but you are free to download and use for any purpose. If you find joy from my work, please feel free to send a zap. Enjoy life on a Bitcoin standard.

![The Bullshit Jobs of Modern Society [2025]](https://image.nostr.build/60b770556804f9cc53a2abdec3e6792a7796ec545fa120676eaf94169a10df37.jpg)

!["Chongming" (Earth Lens 006) - Artist Statement + Photos [2021]](https://image.nostr.build/c36c7826fb94d02f7a6a1ac23c958d603bdeff60b8cd897237ea26336ed23fe7.jpg)

!["CHONGQING" (City Series) - Photos [2021]](https://image.nostr.build/e52daf21f388cdfc8e5d49017bf341c9e42f54e3795d4c0193cf4acd80702e5f.jpg)

!["Grandfather" (Earth Lens 005) - Artist Statement + Photos [2020]](https://image.nostr.build/1d56bf254db02f9efe06383c8ef6c5ffc3377f533cf69ffe3ee045dfe6dfe193.jpg)

!["KYOTO // NIGHTVISION" (City Series) - Photos [2019]](https://image.nostr.build/12b7fc872ec0c151a6d2d0f080a82ee5565ba5012478e14923d911de1dced2e0.jpg)